Insurance Considerations for Commercial Roof Projects sets the stage for this informative discussion, shedding light on the importance of insurance in protecting businesses from potential risks associated with roofing projects. From understanding the types of coverage needed to navigating the claims process, this topic delves into crucial considerations for contractors and property owners alike.

As we delve deeper into the specifics of insurance considerations for commercial roof projects, it becomes evident that a proactive approach to insurance planning can mitigate financial risks and ensure smooth project execution.

Importance of Insurance for Commercial Roof Projects

Insurance plays a vital role in ensuring the success and protection of commercial roof projects. Without adequate insurance coverage, various risks can jeopardize the project and lead to significant financial losses for the stakeholders involved.

Protection Against Natural Disasters

Natural disasters such as hurricanes, tornadoes, or hailstorms can cause severe damage to commercial roofs. Insurance coverage can help mitigate the costs of repairs or replacements in such scenarios, ensuring that the project continues without major setbacks.

Liability Coverage

Accidents can happen on construction sites, and if a worker or third party is injured during the project, liability insurance can cover the associated medical expenses and legal fees. Without this coverage, the project owners could be held personally liable for these costs.

Property Damage

In the event of property damage during the construction process, insurance can cover the costs of repairs or replacements. Whether it's damage to the existing structure or materials being used for the project, having insurance in place can prevent unexpected financial burdens.

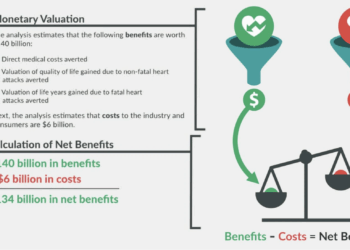

Financial Security

Having comprehensive insurance coverage provides financial security and peace of mind to all parties involved in the commercial roof project. It ensures that any unforeseen circumstances or risks are adequately managed and mitigated, safeguarding the project's success.

Consequences of Inadequate Insurance

Not having adequate insurance coverage for commercial roof projects can result in significant financial losses, delays in the project timeline, and legal disputes. It can also damage the reputation of the project stakeholders and impact future business opportunities.

Types of Insurance Coverage Needed

When it comes to commercial roof projects, there are specific types of insurance coverage that are essential to have in place to protect against various risks and liabilities. Let's delve into the key types of insurance required for such projects.

General Liability Insurance vs. Professional Liability Insurance

General liability insurance is crucial for commercial roof projects as it provides coverage for property damage, bodily injury, and personal injury resulting from your work. On the other hand, professional liability insurance, also known as errors and omissions insurance, covers claims of negligence or inadequate work that result in financial loss for the client.

It's important to have both types of insurance to ensure comprehensive coverage for your roofing projects.

Importance of Workers’ Compensation Insurance

Workers' compensation insurance is vital for roofing projects as it provides coverage for employees who may get injured on the job. Roofing work can be dangerous, with the risk of falls and other accidents, so having workers' compensation insurance in place is crucial to protect your workers and your business.

This insurance helps cover medical expenses, lost wages, and other costs associated with workplace injuries, ensuring that your employees are taken care of in case of an accident.

Insurance Considerations for Roofing Contractors

Roofing contractors play a crucial role in commercial roof projects, and it is essential for them to have adequate insurance coverage to protect themselves and their clients. Here are some key considerations for roofing contractors when it comes to insurance:

Ensuring Adequate Insurance Coverage

Roofing contractors should have general liability insurance to cover any damages or injuries that may occur during the project. Additionally, they should consider getting professional liability insurance to protect against any errors or omissions in their work. It is also important for contractors to have workers' compensation insurance to cover their employees in case of injuries on the job.

Choosing the Right Insurance Policies

When selecting insurance policies, roofing contractors should carefully review the coverage limits, exclusions, and deductibles to ensure they are adequately protected. It is advisable to work with an insurance agent who specializes in construction-related insurance to help navigate the complexities of different policies and find the best coverage for their specific needs.

Role of Subcontractors’ Insurance

Subcontractors working on commercial roof projects should also have their own insurance coverage. Contractors should require subcontractors to provide proof of insurance, including general liability and workers' compensation, before allowing them to work on the project. This helps ensure that all parties involved are protected in case of any accidents or damages.

Claims Process and Documentation

When it comes to filing an insurance claim for commercial roof projects, there are specific steps that need to be followed. Proper documentation plays a crucial role in this process, as it helps in substantiating the claim and ensuring a smoother process overall.

Effective communication with insurance adjusters is also key to a successful claim outcome.

Importance of Proper Documentation

Proper documentation is essential when filing an insurance claim for commercial roof projects. It helps in providing evidence of the damage incurred and the costs involved in repair or replacement. Without adequate documentation, it can be challenging to prove the extent of the damage and justify the claim amount.

- Take detailed photos of the damage before any repairs are made.

- Keep all receipts and invoices related to the roof repair or replacement.

- Maintain a record of any communication with the insurance company.

- Document any additional expenses incurred due to the roof damage.

Effective Communication with Insurance Adjusters

When communicating with insurance adjusters during the claims process, it is important to be clear, concise, and thorough. Providing all necessary information and documentation can help expedite the claim review process and ensure a fair assessment of the damage.

Be prepared to answer any questions the insurance adjuster may have regarding the claim.

- Provide all requested documentation promptly and accurately.

- Keep records of all conversations and correspondence with the insurance adjuster.

- Ask for clarification if you do not understand any part of the claims process.

- Be cooperative and professional in all interactions with the insurance adjuster.

Ending Remarks

In closing, Insurance Considerations for Commercial Roof Projects emphasizes the significance of comprehensive insurance coverage in safeguarding investments and minimizing liabilities. By staying informed about insurance needs and maintaining open communication with insurers, businesses can embark on roofing projects with confidence and peace of mind.

Helpful Answers

What specific risks can insurance cover for commercial roof projects?

Insurance for commercial roof projects can cover risks such as property damage from natural disasters, liability claims from injuries on-site, and financial losses due to project delays.

How can roofing contractors choose the right insurance policies for their projects?

Roofing contractors should assess their project scope, risks involved, and budget constraints to determine the most suitable insurance coverage. Consulting with insurance agents or brokers can also help in making informed decisions.

What role does subcontractors' insurance play in commercial roof projects?

Subcontractors' insurance can provide additional protection by covering liabilities arising from subcontractors' work, ensuring comprehensive coverage for all parties involved in the project.